property tax on leased car connecticut

203 854 - 7770. For example if your.

Buildings Action Business Brokerage Llc And Elm Realty Advisors

The terms of the lease decide which party is responsible for the personal property tax.

. Real and Personal Property Tax Inquiries While people with general questions about the states property taxes can contact the Office of Policy and Management any inquiries about a tax bill. Some build the taxes into monthly. This page describes the taxability of leases and rentals in Connecticut including motor vehicles and tangible media property.

Connecticut car owners including leasing companies are liable for local property taxes. If you purchase a vehicle instead of lease it you are paying sales tax on the entire value of the vehicle sales tax in Connecticut is 635 or 775 for vehicles over 50000 and it is based. The terms of the lease will decide the responsible party for personal property taxes.

The tax collectors office is. However the bill is mailed directly to the leasing company since leased cars are registered in the companys name. Once you have both of these pieces of information you can calculate your vehicle property tax by multiplying the value of your vehicle by the mill rate.

170 rows The local property tax is computed and issued by your local tax collector. Most leasing companies though pass on the taxes to lessees. A dealer who rents a vehicle retains ownership.

In all cases the tax advisor charges the taxes to the. If you terminate your lease it. This page describes the taxability of.

While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. 203 854 - 7731 Facsimile. When you lease a vehicle the car dealer maintains.

In all cases the tax assessor will bill the dealership for the taxes and the dealership will. All tax rules apply to leased vehicles. Tax Collector 125 East Avenue Room 105 Norwalk CT 06851.

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

How To Buy A Leased Car 15 Steps With Pictures Wikihow

There S A Plan To Get Rid Of Connecticut S Property Tax On Cars But How Would Towns Make Up The Difference Hartford Courant

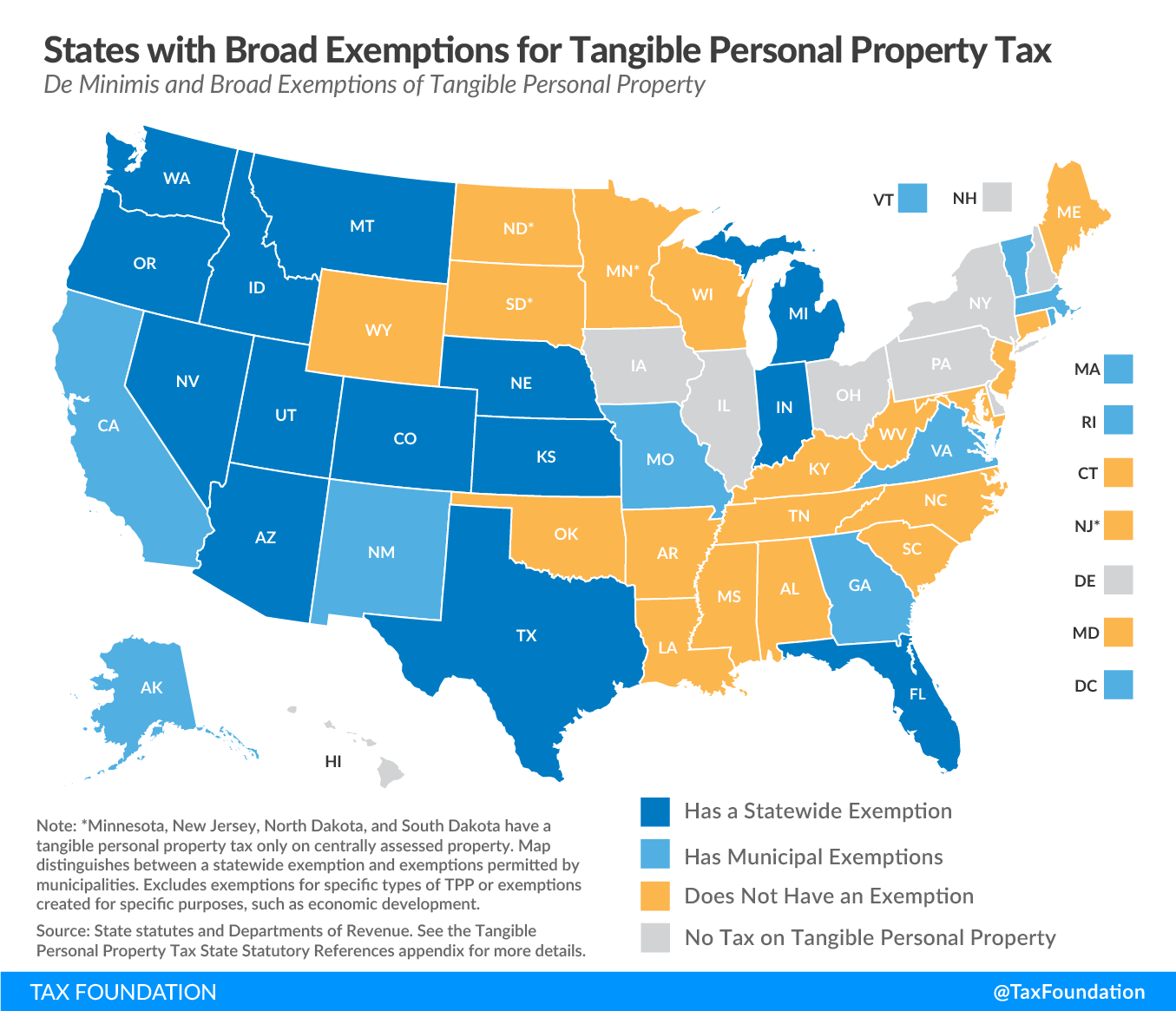

Tangible Personal Property State Tangible Personal Property Taxes

Can I Move My Leased Car Out Of State Moving Com

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct

How Does Leasing A Car Work Shift

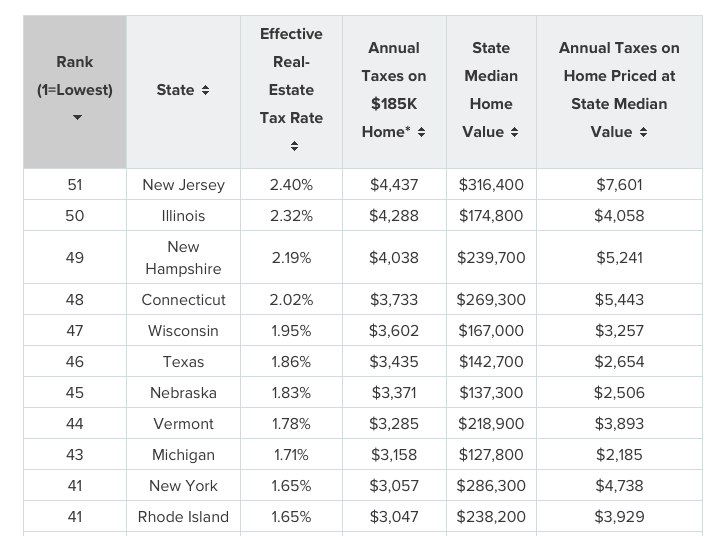

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

What Is A Lease Buyout Keep Your Leased Car Or Sell It Nerdwallet

Connecticut S Sales Tax On Cars

Kevin Hunt Why Am I Paying Sales Tax On Leased Car S Dmv Renewal Fees Hartford Courant

Leasing A Car And Moving To Another State What To Know And What To Do

401 W Main St Norwich Ct 06360 Loopnet

76 Main St Stafford Springs Ct 06076 Loopnet

Ultimate Guide To Registering Your Vehicle In Connecticut Yogov

Five Myths About Leasing A Car Kiplinger

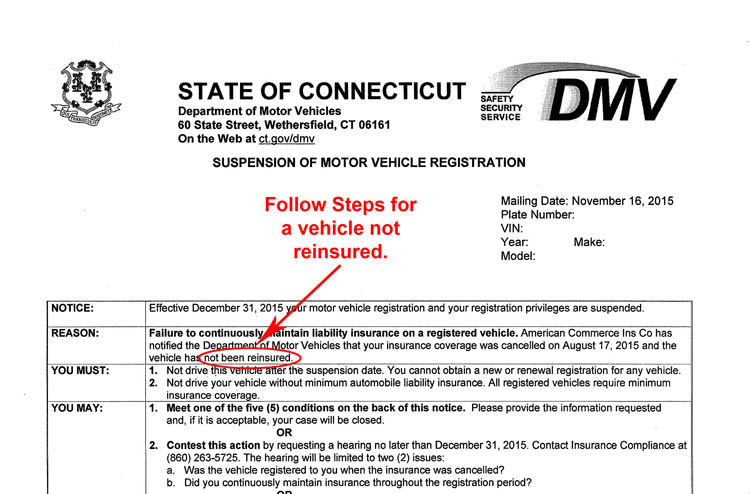

Learn How To Comply With Insurance Tax And Registration Laws Ct Gov

Leasing A Car And Moving To Another State What To Know And What To Do